A security agreement is a legal document that grants the lender specific rights over property pledged as collateral if the borrower defaults. It is the enforcement document a lender can use to ensure the borrower's note is being paid as agreed.

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

A security agreement is a legal document that pledges specific property (collateral) to the lender as security for loan repayment. The collateral protects the lender if the borrower does not repay the loan as agreed. If the borrower defaults, the lender has the right to take ownership of the collateral and sell it to recover their losses.

In real estate investing, the purchased property usually acts as collateral for the loan. For example, if an investor takes out a loan to buy a rental property, that property becomes collateral. If the investor stops making payments, the lender can foreclose on the property to recoup their money.

Other types of collateral besides real estate can include vehicles, equipment, inventory, accounts receivable, securities, or cash. The security agreement spells out exactly what assets are being used as collateral for the loan, unless the parties agree to a general security agreement (GSA).

A general security agreement is more comprehensive type of security agreement, covering all personal property or assets, including future acquisitions. GSAs are particularly versatile, enabling cross-collateralization of various business assets like inventory, equipment, accounts receivable, and intangible properties to support multiple loans.

However, it’s worth noting that GSAs typically do not cover real property (land and buildings), as these are often subject to separate mortgage agreements due to distinct legal requirements.

While security agreements vary depending on the lender and type of loan, most contain several standard elements:

The security agreement remains in effect until the borrower pays the loan off or the lender releases the collateral. It ensures the lender has legal recourse if the borrower does not fulfill their obligations.

One of the most important aspects of a security agreement is defining what constitutes a default.

For a real estate loan, consistently missing mortgage payments over a certain timeframe is typically considered default. However, the agreement may allow for some flexibility, such as a grace period before default is triggered.

Other events that could cause default include:

If any of these default conditions occur, the lender has the right to take action against the collateral, such as foreclosure on a mortgage. It’s critical for borrowers to avoid default at all costs by carefully adhering to the loan terms.

Once a default is established, the security agreement grants the lender certain remedies they can pursue to recover their investment.

Under the security agreement, they have significant power to pursue the collateral through foreclosure or repossession. They may also call for acceleration, which calls for the entire outstanding loan balance to be immediately due and payable, or sue the borrower for a deficiency judgment for any remaining unpaid portion of the loan after selling the collateral.

In any case, lenders may also charge administrative fees for expenses incurred in the default and repossession process.

While default rights favor the lender, the security agreement also outlines responsibilities for borrowers:

Fulfilling these obligations is critical to avoiding default. Borrowers must carefully manage collateral assets and honor all loan repayment terms. Failing to do so can result in serious legal and financial consequences.

While security agreement, security interest, and security instrument are sometimes used interchangeably, there are important differences between these terms:

A security agreement is a written contract that creates or provides for a security interest. It includes granting language and outlines the collateral, obligations, and rights of the borrower and lender.

A security interest is the “stake” a lender has in the borrower’s collateral. A security agreement establishes this interest and grants the lender certain legal rights over the collateral.

The security instrument is a legal document, such as a mortgage or deed of trust, that perfects the security interest in real property collateral. It must be properly recorded with the local land records office.

In a nutshell, a security agreement creates the security interest, while a security instrument legally perfects and documents that interest for real property collateral on public record. The security interest itself refers to the legal rights and power the lender obtains over pledged assets.

Declining collateral value alone doesn’t trigger default as long as payments are kept current. However, the lender assumes some risk that collateral may depreciate over the loan term.

However, borrowers remain responsible for any deficiency if the collateral is later sold for less than the outstanding loan balance.

Yes, collateral in a security agreement can be substituted, but this process involves specific conditions and formalities.

For instance, in a practical setting, when customers wish to substitute collateral (like swapping one vehicle for another of equal or greater value as collateral for the same loan), it’s recommended not to allow such substitutions directly due to potential complications during repossession.

Instead, the existing loan should be closed out, and a new loan should be created for the new item to ensure clarity and avoid legal or operational issues. This approach helps maintain clear records and avoids confusion over the collateral securing the loan.

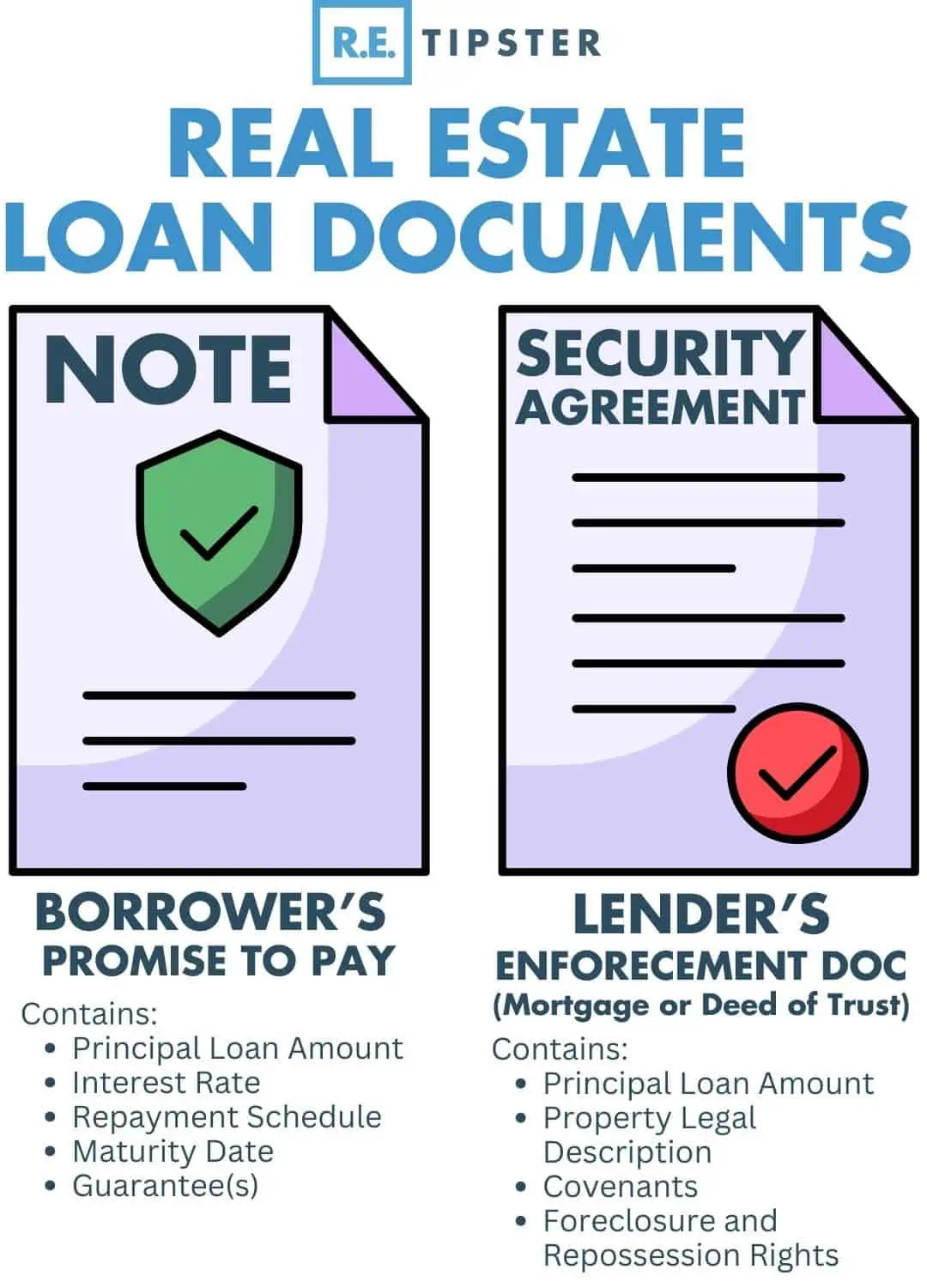

Related documents typically include the security agreement, loan agreement, promissory note, and mortgage (if real estate is used as collateral). Title insurance may also be required to protect the lender’s interest in the collateral property. Borrowers should obtain and understand all applicable loan documents.